Is the long, arduous wait nearly over? Brexit deal closes in

- Go back to blog home

- Latest

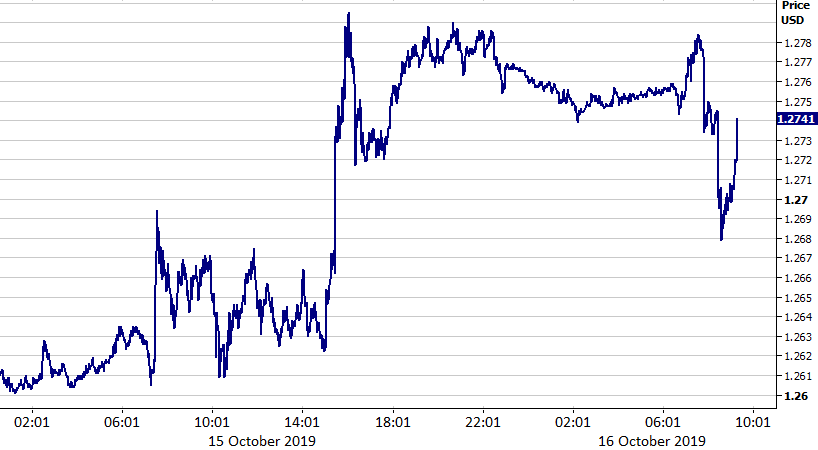

The pound had another great day of trading yesterday, rallying by over one percent against the US dollar to just shy of the 1.28 mark at one stage on signs that a revised Brexit agreement could be close.

Discussions will, of course, resume today in the hopes of striking at agreement before the two-day EU summit, which commences on Thursday. A deal would need to be ratified by all 27 other EU members at the summit before it is able to go to a House of Commons vote. Should the UK not present a revised deal in time, Boris Johnson is still required by law to ask for an extension to the Brexit deadline of three months on Saturday.

Investors have not got too carried away with themselves this morning, with the pound retracing around half a percent during early European open. It is worth noting that the Tories coalition partner, the DUP, has already expressed unease at the prospect of an agreement. Johnson’s coalition partners seem hard to please at the best of times, which is unfortunate for the Prime Minister given he’s very likely to need their support in the House of Commons, particularly now his majority in government is gone.

Figure 1: GBP/USD & GBP/EUR (15/10 – 16/10)

As we expected, investors mostly overlooked yesterday’s UK labour report which was, as it happens, broadly in line with expectations.

German business sentiment remains low

News from elsewhere was once again almost completely overshadowed by events in the UK on Tuesday.

The common currency received some assistance from the headlines that a Brexit deal could be close, given the perceived negative impact a ‘no deal’ could also have on the European economy, although gains were fairly limited. Tuesday’s ZEW economic sentiment data provided at least some reason to be less pessimistic over the Eurozone economy, although the overall picture still looks grim. The main economic sentiment index for Germany was better-than-feared, although remained deep in negative territory at -22.8. This suggests that European businesses are fearful of a possible slowdown in activity in the coming months.

Wednesday should be a day jam packed with both political news and macroeconomic data. Inflation numbers out of both the UK and the Eurozone are set for release this morning. Then, this afternoon, we’ll see the latest retail sales numbers from the US. This should give us a decent indication as to how the US consumer is faring going into the latter stages of 2019.