Unveiling 2024: Market Outlook and Key Trends Get your free copy

-

UK

- Australia - English

- België - Nederlands

- Belgique - Français

- Brazil - Portuguese

- Canada - English

- Česká Republika - Čeština

- Deutschland - Deutsch

- España - Español

- France - Français

- Ελλάδα - Ελληνικά

- Hong Kong - English

- Hong Kong - Traditional Chinese

- Italia - Italiano

- Luxembourg - English

- Nederland - Nederlands

- Polska - Polski

- Portugal - Português

- România - Română

- Schweiz - Deutsch

- Suisse - Français

- Sverige - Svenska

- United Arab Emirates - English

-

United Kingdom - English

Contact our experts

Ebury London

100 Victoria Street

London

SW1E 5JL

+44 (0) 20 3872 6670

[email protected]

Ebury.com

Sterling slides to two-month low as Brexit pressures mount

- Go back to blog home

- Latest

24 April 2019

Senior Market Analyst at Ebury. Providing expert currency analysis so small and mid-sized businesses can effectively navigate international markets.

Sterling sank back below the 1.30 mark against the US Dollar on Tuesday, falling to its weakest position in two months on a stronger greenback and renewed concerns over Brexit.

The Pound had already lost almost half a percent of its value prior to her comments as some strong US data fuelled a Dollar rally across the board. Investors also began ramping up bets that Theresa May’s position as PM could be under threat after an FT report claimed that another vote on her withdrawal agreement could be held as soon as next week. Another defeat here would compound losses for the Pound and heighten calls for the Prime Minister to step down.

US Dollar soars on hopes of solid GDP numbers

As mentioned, the US Dollar put in a very strong performance on Tuesday, rallying by around 0.5% versus the Euro during the course of the day.

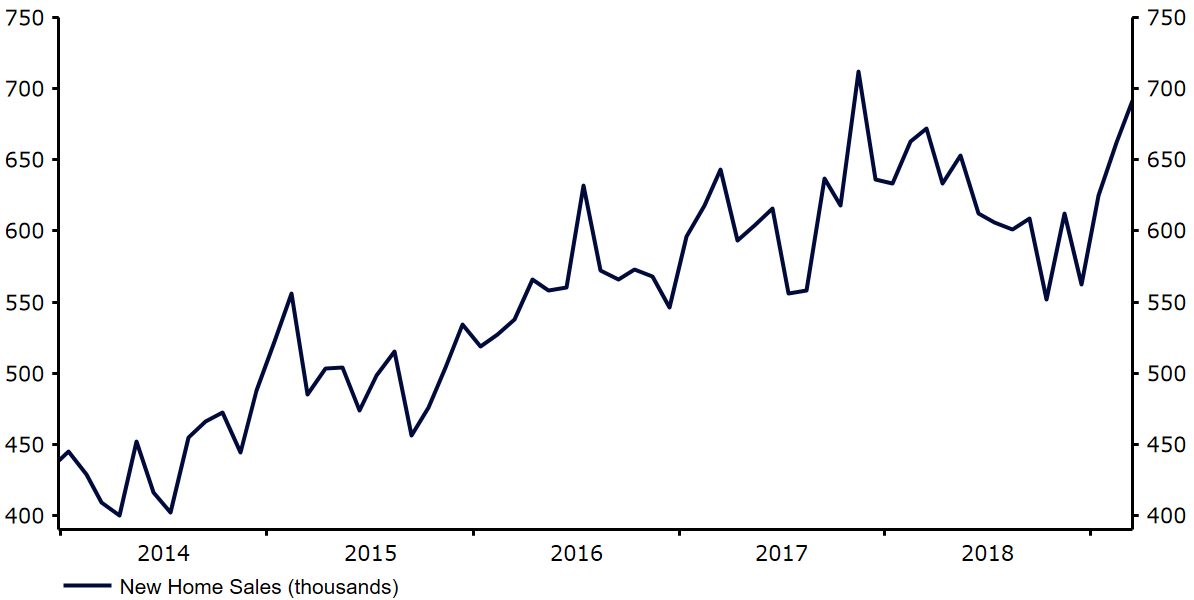

Some pretty solid macroeconomic data out of the world’s largest economy has raised optimism that Friday’s preliminary first quarter growth number for the US could come in much stronger than initially feared. US new home sales rose to a sixteen month high in March according to data released yesterday, while last week’s retail sales numbers were among the strongest month-on-month since the financial crisis. The market is now eyeing a pretty solid growth number around the 1.8% annualised level. While much slower than recorded throughout much of last year, this would be considerably better than the market had feared a matter of a few weeks ago.

Figure 1: US New Home Sales (2014 – 2019)

German business confidence falls again

Another set of soft economic news out of the Eurozone heaped additional pressure on the common currency this morning, while raising additional concerns over a possible slowdown in the bloc’s economy in 2019.

The monthly German sentiment indices from IFO all fell short of expectations. The business climate index declined to 99.2 this month after investors had eyed a reading around the 99.9 mark, remaining around its lowest level since the beginning of 2016. Economic data has remained disappointing in the bloc for some time and so long as this continues we think that the Euro is unlikely to post any meaningful gains from current levels.

Data is relatively light in the Eurozone for the rest of the week, meaning that the Euro is likely to be driven largely by events elsewhere.

Cookies and Privacy

This site uses cookies to ensure you get the best experience. For more information see our Privacy NoticeAccept Settings Reject

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cf_use_ob | past | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _ga_P8154YCRDP | 2 years | This cookie is installed by Google Analytics. |

| _gat_gtag_UA_51187572_50 | 1 minute | Google uses this cookie to distinguish users. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| _hjFirstSeen | 30 minutes | This is set by Hotjar to identify a new user’s first session. It stores a true/false value, indicating whether this was the first time Hotjar saw this user. It is used by Recording filters to identify new user sessions. |

| _hjid | 1 year | This cookie is set by Hotjar. This cookie is set when the customer first lands on a page with the Hotjar script. It is used to persist the random user ID, unique to that site on the browser. This ensures that behavior in subsequent visits to the same site will be attributed to the same user ID. |

| CONSENT | 16 years 4 months 14 hours 27 minutes | These cookies are set via embedded youtube-videos. They register anonymous statistical data on for example how many times the video is displayed and what settings are used for playback.No sensitive data is collected unless you log in to your google account, in that case your choices are linked with your account, for example if you click “like” on a video. |

| pardot | past | The cookie is set when the visitor is logged in as a Pardot user. |

| Cookie | Duration | Description |

|---|---|---|

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| yt-remote-connected-devices | never | These cookies are set via embedded youtube-videos. |

| yt-remote-device-id | never | These cookies are set via embedded youtube-videos. |

| Cookie | Duration | Description |

|---|---|---|

| _lfa | 2 years | This cookie is set by the provider Leadfeeder. This cookie is used for identifying the IP address of devices visiting the website. The cookie collects information such as IP addresses, time spent on website and page requests for the visits.This collected information is used for retargeting of multiple users routing from the same IP address. |