Unveiling 2024: Market Outlook and Key Trends Get your free copy

-

UK

- Australia - English

- België - Nederlands

- Belgique - Français

- Brazil - Portuguese

- Canada - English

- Česká Republika - Čeština

- Deutschland - Deutsch

- España - Español

- France - Français

- Ελλάδα - Ελληνικά

- Hong Kong - English

- Hong Kong - Traditional Chinese

- Italia - Italiano

- Luxembourg - English

- Nederland - Nederlands

- Polska - Polski

- Portugal - Português

- România - Română

- Schweiz - Deutsch

- Suisse - Français

- Sverige - Svenska

- United Arab Emirates - English

-

United Kingdom - English

Contact our experts

Ebury London

100 Victoria Street

London

SW1E 5JL

+44 (0) 20 3872 6670

[email protected]

Ebury.com

Emerging market rally continues as investors chase yields

- Go back to blog home

- Latest

8 April 2019

Chief Risk Officer at Ebury. Committed to mitigating FX risk through tailored strategies, detailed market insight, and FXFC forecasting for Bloomberg.

As trade tensions between the US and China recede, and Chinese data improves, investors are feeling increasingly comfortable with the macroeconomic and policy backdrop worldwide.

This week, the ECB and the Federal Reserve will drive currency markets. The latter will publish the minutes from its last meeting, while the former will hold its April meeting. We expect both central banks to reiterate to markets their willingness to remain in a wait-and-see pattern for the foreseeable future.

Major currencies in detail

GBP

Theresa May tried to break the stalemate over Brexit by opening talks with opposition leader Jeremy Corbyn. As this is written, little progress seems to have been made, and a long extension or series of extensions to the Brexit deadline appears increasingly likely.

The two key factors driving Sterling this week will be the progress, or lack thereof, on the May-Corbyn talks and the EU Council meeting on Wednesday that is expected to rule on May’s request of an extension to Brexit to 30th June.

EUR

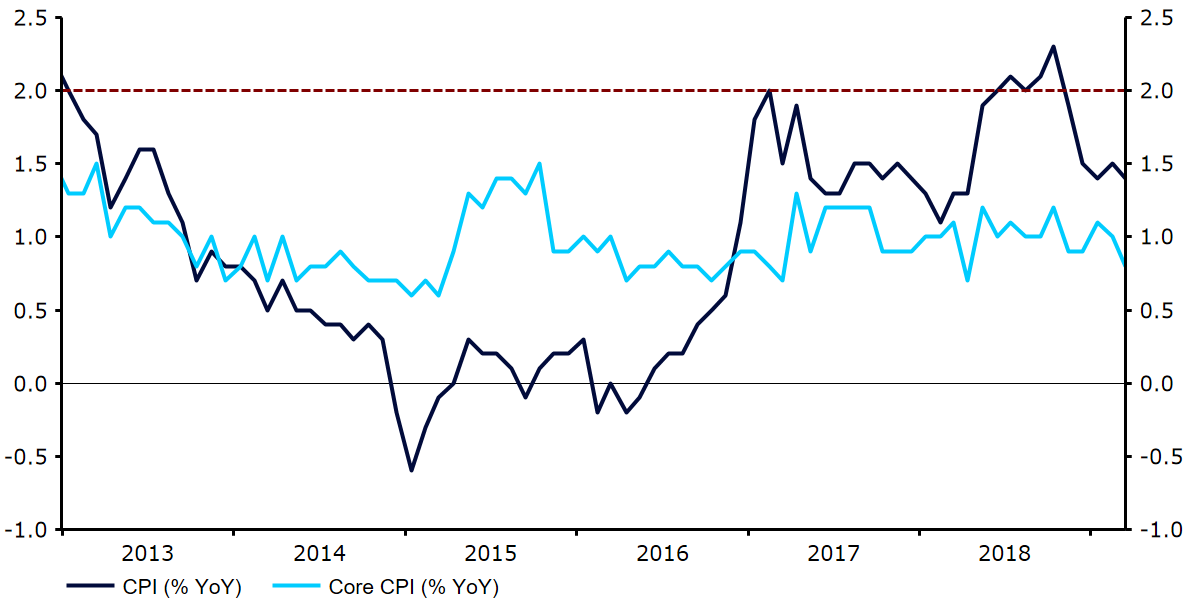

The ECB received some further bad news last week after the preliminary core inflation rate for March came in at a worse-than-expected 0.8% versus 0.9% that the market had priced in (Figure 1). This remains far from the institution’s target of “close to, but below 2%” and its lowest level in almost a year. Retail sales for February in the Eurozone rose 2.8% from the previous year. All in all, it seems likely that the economy will continue to post moderate gains for 2019, supported by the ECB’s monetary stimulus.

Figure 1: Eurozone Core Inflation (2013 – 2019)

We do not expect any monetary policy changes at the April meeting on Thursday, but there will be some lively discussion around the ECB’s option should it want to make policy even more stimulative, and the effect of negative rates on the banking system.

USD

Job creation in the US rebounded in March from the February dip. Labour data thus adds to the narrative that the slowdown seen in the early weeks of 2019 was a temporary phenomenon, likely driven at least in part by statistical quirks of seasonal adjustment in the first quarter.

In addition to the Fed minutes from the March meeting, inflation data out Wednesday will provide a test to the Federal Reserve’s new stance that it can be relaxed about inflationary pressures and hold rates unchanged for the remainder of 2019.

Cookies and Privacy

This site uses cookies to ensure you get the best experience. For more information see our Privacy NoticeAccept Settings Reject

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cf_use_ob | past | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _ga_P8154YCRDP | 2 years | This cookie is installed by Google Analytics. |

| _gat_gtag_UA_51187572_50 | 1 minute | Google uses this cookie to distinguish users. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| _hjFirstSeen | 30 minutes | This is set by Hotjar to identify a new user’s first session. It stores a true/false value, indicating whether this was the first time Hotjar saw this user. It is used by Recording filters to identify new user sessions. |

| _hjid | 1 year | This cookie is set by Hotjar. This cookie is set when the customer first lands on a page with the Hotjar script. It is used to persist the random user ID, unique to that site on the browser. This ensures that behavior in subsequent visits to the same site will be attributed to the same user ID. |

| CONSENT | 16 years 4 months 14 hours 27 minutes | These cookies are set via embedded youtube-videos. They register anonymous statistical data on for example how many times the video is displayed and what settings are used for playback.No sensitive data is collected unless you log in to your google account, in that case your choices are linked with your account, for example if you click “like” on a video. |

| pardot | past | The cookie is set when the visitor is logged in as a Pardot user. |

| Cookie | Duration | Description |

|---|---|---|

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| yt-remote-connected-devices | never | These cookies are set via embedded youtube-videos. |

| yt-remote-device-id | never | These cookies are set via embedded youtube-videos. |

| Cookie | Duration | Description |

|---|---|---|

| _lfa | 2 years | This cookie is set by the provider Leadfeeder. This cookie is used for identifying the IP address of devices visiting the website. The cookie collects information such as IP addresses, time spent on website and page requests for the visits.This collected information is used for retargeting of multiple users routing from the same IP address. |