Dismal PMIs sink Euro ahead of European Central Bank announcement

- Go back to blog home

- Latest

The Euro broke out of the narrow range it has been stuck in so far this week against the US Dollar ahead of this afternoon’s monetary policy announcement from the European Central Bank.

With a rather downbeat tone already largely priced in, it may take a fairly significant change in stance, perhaps the suggestion that QE could be restarted should conditions worsen, to see any material sell-off in the Euro this afternoon. On the flip side, we think that Draghi will stress that discussions over the timing of the first rate hike have still not begun, thus limiting any upside moves. More of the same from Draghi and a fairly limited reaction in EUR/USD seems the best bet to us, although a return of volatility in the pair cannot be ruled out following Draghi presser at 13:30 UK time.

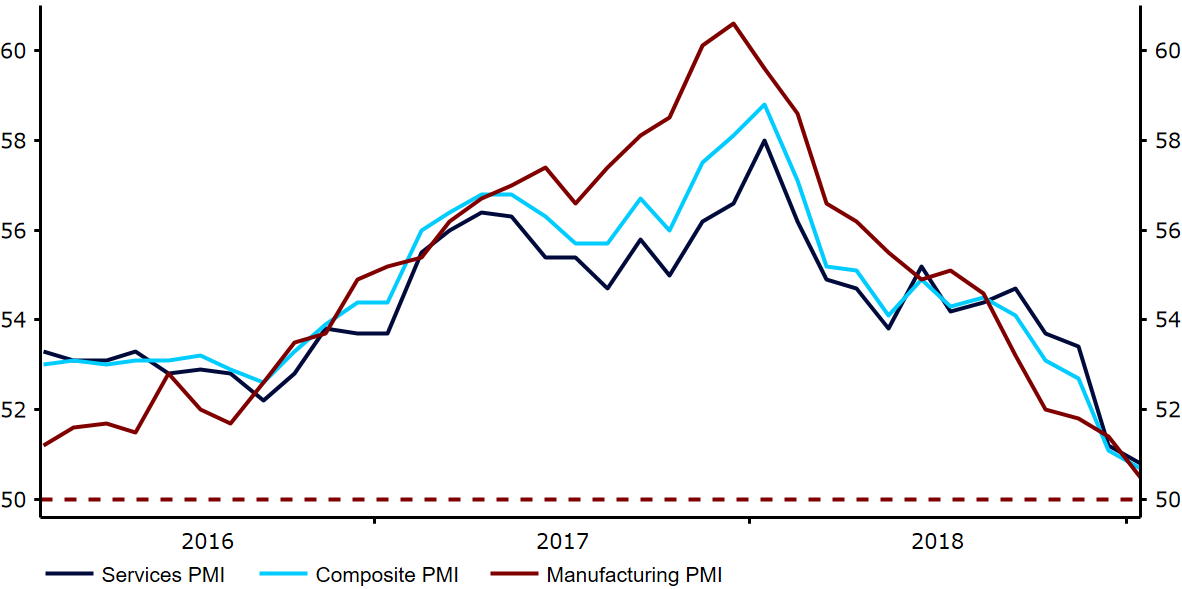

Ahead of today’s announcement, the Euro fell sharply following the release of a dismal set of Euro-area PMIs. The composite index sank to 50.7, barely in expansionary territory, from 51.1, its lowest level in 66 months (Figure 1).

Figure 1: Eurozone PMIs (2016 – 2019)

Dimming ‘no deal’ Brexit chances lift Sterling

This week’s seemingly relentless upward march in the Pound continued on Wednesday, with Sterling jumping by almost one percent for the day against the US Dollar to its strongest position since early-November.

Currency traders are now almost completely pricing out the possibility of a ‘no deal’ Brexit and are now instead placing bets on a delayed and softer Brexit. The chances of an extension to Article 50 increased further yesterday after the Labour Party claimed that it would likely throw support behind an amendment to the Brexit bill that would prevent a ‘no deal’. Labour MP Yvette Cooper’s proposed amendment could potentially mean that Theresa May is given until 26th February to ensure a deal is approved in a parliament vote before MPs vote on whether Brexit is delayed, potentially until the end of the year. With almost a dozen Labour Party members already voicing support for the motion, there is a decent chance of the amendment passing when the House of Commons votes next week.

Senate set to vote against Trump’s spending plan

The US government shutdown continues to limit major market moving news across the pond.

The Senate is today expected to vote on Trump’s latest proposal that could reopen government until 8th February. That being said, the chances of the vote actually passing appear relatively slim, given that neither the Republicans or the Democrats has a majority and continue to come to blows on how to solve the impasse. In the very unlikely event that the vote does in fact pass, we would expect a fairly sharp upward move in the greenback.

As mentioned, still no major data out of the US today due to the shutdown, although this afternoon’s manufacturing PMI could receive some attention. The EUR/USD cross is likely to be driven more by the ECB announcement.